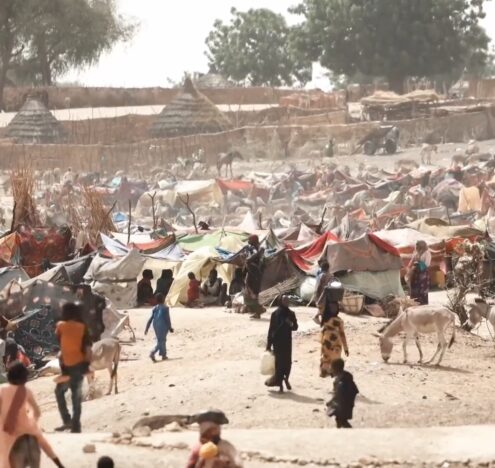

At the height of conflicts, incumbent governments are preoccupied with strategy and tactics. International donors focus on directing aid toward emergency and humanitarian relief. But these efforts overlook another pressing need, as millions of citizens are forced to flee their homes for their safety.

On Feb. 24, 2022, Russia’s President Vladmir Putin announced a “special military operation,” launching the Russian invasion of Ukraine. At the time, few thought this war would last as long as it has, yet here we are. Based on the International Organization of Migration’s findings, as of Jan. 23, 2023, 5.4 million people are internally displaced across Ukraine, and 62% of these Internally Displaced Persons need financial support. Now beyond the one-year anniversary of the invasion of Ukraine, we must shed light on this oversight and recognize how remittances could be a temporary lifeline for IDPs.

One of the most significant consequences of wars and conflicts is poverty and the inability to recover economically. The loss of assets, the disruption of education, and the destruction of businesses cause displaced people to spiral into financial misery. While remittances alone are not enough to alleviate sustained poverty caused by war, they can aid families in the interim.

HOW REMITTANCES CAN HELP

During a conflict, IDPs face an uncertain future, and so are less likely to invest in their homes or new business endeavors, resulting in less wealth for the next generation. However, suppose relatives and friends living abroad could financially support internally displaced families to meet their basic needs? In that case, those families would be more likely to maintain a stable situation and resume day-to-day activities, even if unable to produce intergenerational wealth.

WHILE REMITTANCES ALONE ARE NOT ENOUGH TO ALLEVIATE SUSTAINED POVERTY CAUSED BY WAR, THEY CAN AID FAMILIES IN THE INTERIM.

Our recent working paper analyzes the impact of remittances on IDPs’ consumption patterns. Remittance is a good method for emergency relief, mainly used by conflict survivors for their basic needs and to acquire consumer goods. We find that IDPs with connections abroad can spend a larger portion of their income on durable goods such as phones, TVs, computers, and vehicles, which greatly increase their quality of life.

However, we also find that receiving remittances does not guarantee wealth generation over time. Internally displaced families do not spend their income on wealth-generating investments after a conflict ends. As puzzling as that may seem, we hypothesize that the reason could be that the families remain unsettled even though the war has ended–in other words, the uncertainty of their situation has not changed. Given their temporary mindset and reliance on outside resources to sustain their daily lives, they see no reason to invest in a long-term future through land acquisitions, setting up new businesses, or investing in their homes.

HINDRANCES TO REMITTANCES

While laying the groundwork for the research on remittances’ impact, we interviewed the Sri Lankan diaspora in Denmark. One of the questions we discussed with them was the obstacles to sending remittances to their loved ones who were stuck back home in the war. They reported that the biggest hindrances were transaction fees and IDPs’ lack of access to nearby banks. Most of the diaspora we spoke to sent their remittances through informal channels, such as Hawala or Hundi systems, both of which are alternative remittance systems that operate outside formal banking channels, at the height of the war. For example, if a person in Denmark wanted to send money to their family member in Sri Lanka, they would contact a hundi operator to transfer the funds. The Danish hundi operator would reach out to a hundi operator in Sri Lanka, who will give the money to the family member. Here the Danish hundi operator did not give the remitter a receipt, and he only keeps records of how much money he owes the hundi operator in Sri Lanka rather than individual remittances made. Unfortunately, sometimes the money sent through these informal transaction networks never reaches its intended recipients.

We urge governments and formal banking systems to offer more official and cheaper alternatives to the many informal transaction networks such that delivery of remittances can be guaranteed.

As the Ukraine war continues, displaced people lack employment opportunities and the financial means to accumulate wealth and improve their economic standing. Some even need help to satisfy their basic needs, such as finding stable accommodation.

The impact of remittances on internally displaced families is not limited to Ukraine but is seen in conflicts worldwide. We must seek solutions for displaced people suffering and stuck in a survival mode mentality. International institutional support of remittances could facilitate the resettlement of IDPs, relieve their financial pressure, and potentially avoid persistent poverty for future generations.