This month El Salvador became the first country in the world to adopt Bitcoin as legal tender. The move was criticized by Bitcoin skeptics and denounced as a scam aimed at helping President Nayib Bukele take a step away from the rules and regulations that govern the US dollar, the official currency of the country. Most importantly, the move was met with protests at home where Salvadorians assert that the new tender doesn’t work for them, an understandable worry in a country with an internet penetration rate of only 34%. Some 1,500 miles southeast of El Salvador, Venezuela has gone through dozens of currency changes in a series of desperate bids for an economy that has been steadily contracting for at least a decade.

Should Venezuela follow El Salvador’s path and adopt Bitcoin or should it do something else?

THE CURRENCY THAT KEEPS DEVALUING

Venezuelans have been contending with hyperinflation, multiple devaluations, a prohibition on even referencing US dollars, and at one point even a government-sponsored cryptocurrency. Last year, Venezuela had the worst inflation rate of any country in the world. A couple of years earlier, The Economist had estimated that the Bolívar Fuerte, the national currency of Venezuela, had lost 99.9% of its value in the two year period before 2018. This year the same publication declared the Bolivar Fuerte the world’s most overvalued currency.

Hyperinflation and overvaluation affect every transaction in Venezuela. For example, at the start of this year $1 USD was equivalent to about Bs.F. 1.6 million. By the start of this month, the Bolívar Soberano had lost so much value that $1 USD is now closer to Bs.F. 4.10 million. Numbers this big make simple transactions practically impossible.

Ultimately, the 28 million people who reside in Venezuela continue to find ways to make their country and its economy work, but it’s important that they are able to buy and sell goods and services without resorting to store-branded IOUs.

Consider this: The BigMac index tells us that a basket of goods is relatively more expensive in Venezuela, so that the burger that costs about $5.65 in the US costs about $8.35 in Caracas. That amount becomes nearly Bs.S.14 million. When people are paying millions of something for a hamburger, the math gets hard and paying cash becomes impossible. The highest bill in circulation in the country right now is a Bs.S. 100,000,000 note. Even if you were to pay using only those bills you’d need 14 bills to pay for a hamburger. Those are 14 bills that the customer would have to count, then the cashier would have to count, then a manager, then a bank teller, and so on.

Managing that amount of cash for such low value transaction adds sand to the wheels of an already dwindling economy. Moreover, it’s not clear that there is even enough cash in existence in the country to carry out these transactions. The Venezuelan Central Bank hasn’t updated reports of cash in circulation since 2007, when it estimated that about 12 million Bs.F. 50,000 notes were in circulation.

Paying with debit or credit cards is complicated as well. Approximately one in four Venezuelan adults don’t have a bank account. While this percentage is much lower than in El Salvador where close to 70% of the adult population does not have a bank account, it is still very high for a country with so little cash in circulation. Those who do have credit cards have spending limits that do not allow for normal spending: The highest spending limit on platinum cards is reportedly Bs.S.80,000,000. That sounds like A-lister money but is only US $19.64 at today’s exchange rate. Frequent power outages add another complication to payment in any kind of plastic.

CUTTING THE ZEROS…

The government has attempted to address these issues two ways. First, it started cutting zeroes out of the currency. The government lopped three zeroes off the currency in 2007 and renamed what had until then been called simply the “Bolívar,” the “Bolívar Fuerte” (“Strong Bolívar.) A decade later, in 2018, with hyperinflation still out of control the government slashed another three zeros and renamed the currency the “Bolívar Soberano” (“Sovereign Bolívar). Last month the government said it would pursue this strategy again, this time slashing six zeros.

The government also pursued a second strategy to deal with hyperinflation: After years of prohibiting even the mention of the word “dollar,” the government changed course in 2018 to allow the use of the US dollar in the country. While helpful for dealing with transactions that would otherwise have taken hundreds of bills, the move is not a complete dollarization and comes with problems of its own. In El Salvador, which adopted dollarization two decades ago, citizens that have bank accounts can withdraw US dollar bills from ATMs and use those to pay for everyday goods and services. In Venezuela, such convenience is not available. Even so, finding the large amounts of Bolívares required to complete a purchase in the official currency of the country is harder even than trying to find another country’s currency, the dollar. The problems with the Venezuelan currency are so severe that a recent survey estimated that 57% of transactions in the country are carried out using US dollars.

…ISN’T ENOUGH

Despite the widespread use of the US dollar by Venezuelan citizens, the government has resisted full dollarization, likely in part because it would go against the anti-American rhetoric started by former president Hugo Chávez Frías who infamously commented that it “smells like sulfur” after then-US president George W. Bush walked into a meeting of the United Nations. Without full dollarization, Venezuelans have to rely on a limited supply of American cash and the use of online payment systems, such as Zelle. To use Zelle, Venezuelans need access to bank accounts in the US, which many acquired in the by-gone days in which travel outside the country was relatively inexpensive. In addition to access to an American bank account, you also need power and internet to run Zelle, so the solution is by no means perfect.

A typical transaction at a supermarket in Caracas thus becomes more of a negotiation than a payment: The cashier can tally up the groceries and then the customer has to figure out what combination of the goods in the cart can be paid with whatever combination of dollars and bolívares is available that day. The process can involve adding and removing items from the cart as both parties try to agree to an exchange. It can also leave customers short-changed. One private company came up with an innovative solution: Hand out store credit to the customers when cashiers were unable to give back change.

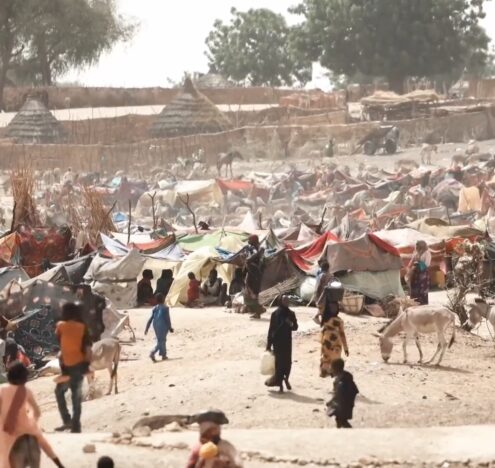

Ultimately, the 28 million people who reside in Venezuela continue to find ways to make their country and its economy work. Even as the plight of Venezuelan migrants makes the news almost every week, the number of people still living in the country is more than five times greater than the number of Venezuelan refugees and migrants. It’s important that people in Venezuela are able to buy and sell goods and services without resorting to store-branded IOUs.

DOLLARIZATION IS THE SOLUTION

One possible way to get out of this situation would be for the government of Venezuela to adopt dollarization in earnest, rather than the piecemeal approach it has adopted so far. Adopting dollarization would put an end to hyperinflation (as it did for Ecuador in 2000.) It will also allow the Venezuelans that still reside inside their country to be able to participate in the economy. This in turn is important to everyone that is interested in seeing a return to democracy in the country because ultimately the 28 million Venezuelans in the South American country have a much better chance of affecting regime change there than the 5 million scattered around the world.

For now, however, the government hasn’t made dollarization its official policy. Instead, Nicolás Maduro announced earlier this year that the goal for this year is to “establish a digital economy.” For now it appears that whatever “a digital economy” means, it does not mean much-needed dollarization or an El Salvador-style move to Bitcoin.

Fabiana Sofia Perera is an assistant professor at the William J. Perry Center for Hemispheric Defense Studies. She grew up in Caracas and has conducted extensive fieldwork in Venezuela. The views expressed here do not reflect the views of the Department of Defense or the US government.